Introduction

If you’re preparing to launch on AWS Marketplace, you’ll quickly face a key strategic question:

Do you focus on self-serve buyers, or invest in AWS Co-Sell motions with field sellers?

Both paths can work. Both can generate revenue. But they require different content, sales motions, and expectations. In this article, we’ll break down each approach, its advantages, trade-offs, and how to decide which strategy fits your product stage.

The Self-Serve AWS Marketplace Strategy

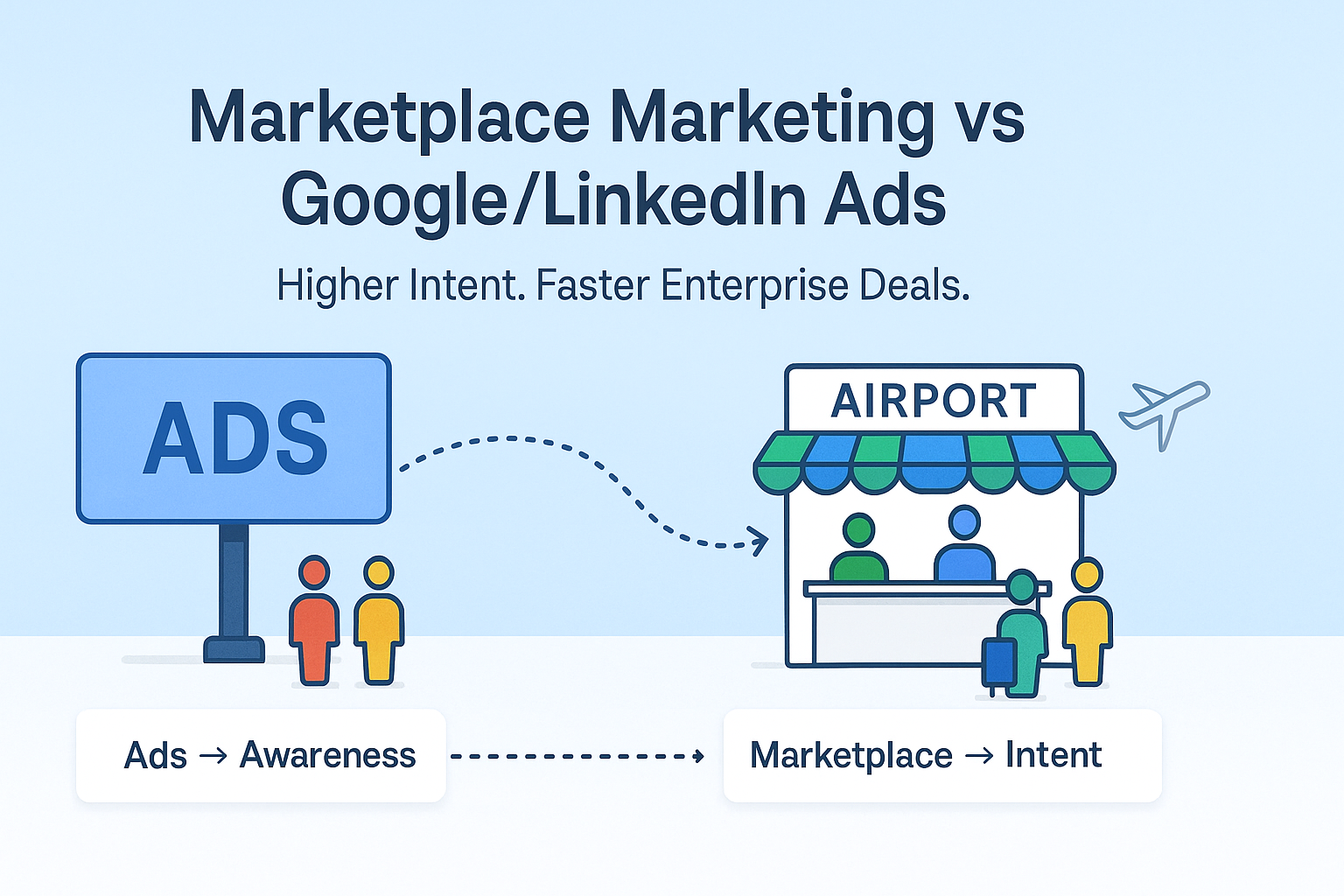

The self-serve approach treats AWS Marketplace like a high-trust eCommerce channel.

Buyers discover, evaluate, and purchase your product without ever speaking to your sales team.

Best for:

- SaaS products with developer adoption models

- Tools with clear use cases and pricing (e.g., DevOps, data APIs, monitoring)

- Freemium or trial-driven growth models

- Startups or SMB-focused GTM motions

What You Need:

- Frictionless listing → clear descriptions, AWS services mentioned, one-click deployment

- Transparent pricing → hourly, monthly, or usage-based

- Strong onboarding docs → deployment guides, FAQs, architecture diagrams

- Case studies → even short ones help build credibility

Why It Works:

- Scales quickly with minimal sales overhead

- Captures bottom-up adoption among developers and teams

- Creates steady inbound flow with little human intervention

Think of it as the “SaaS free trial” model, just AWS-powered.

The Co-Sell AWS Marketplace Strategy

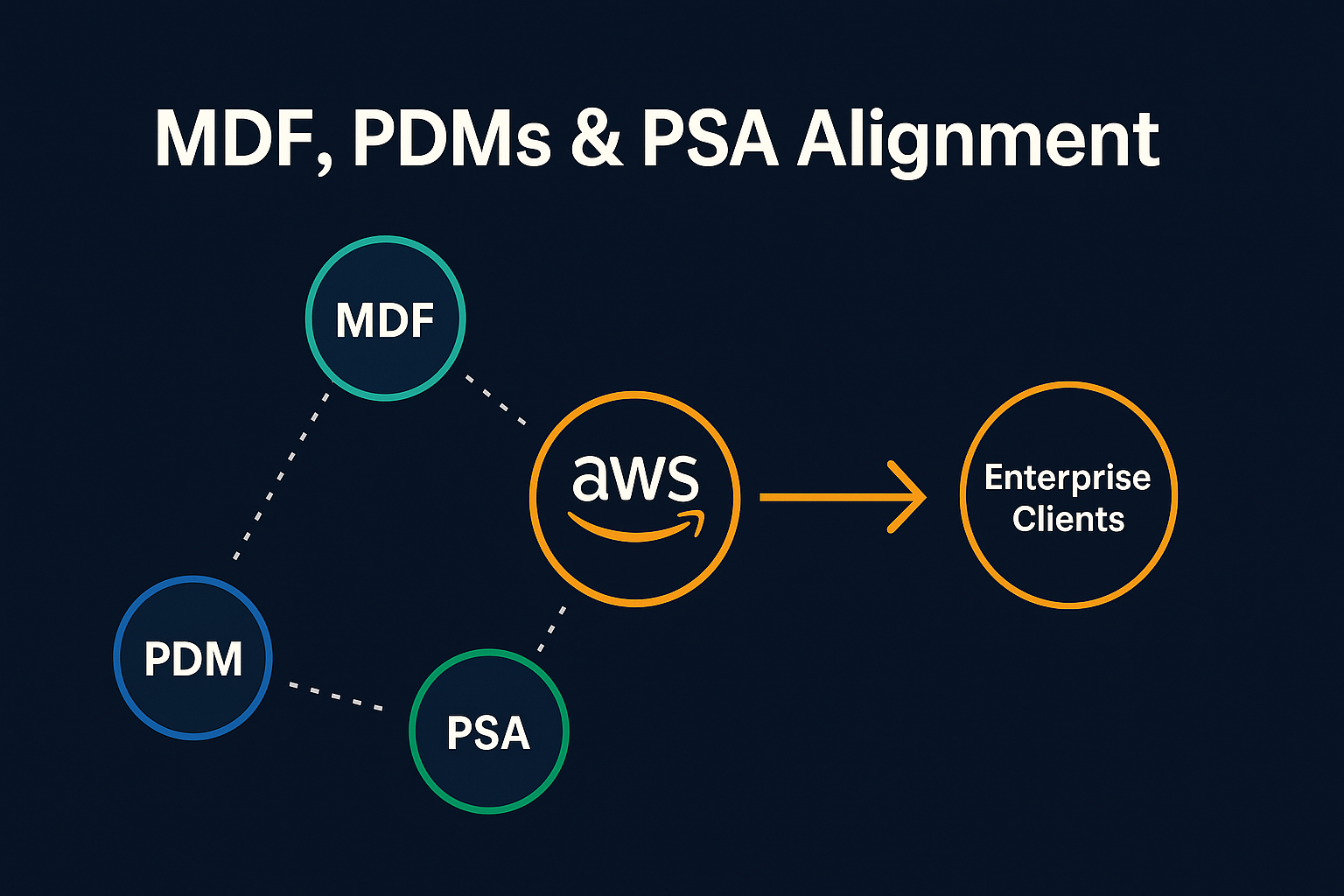

The Co-Sell motion leverages AWS Partner Managers, Account Executives, and Solutions Architects to introduce your product into enterprise sales cycles.

Best for:

- Solutions with complex buying processes

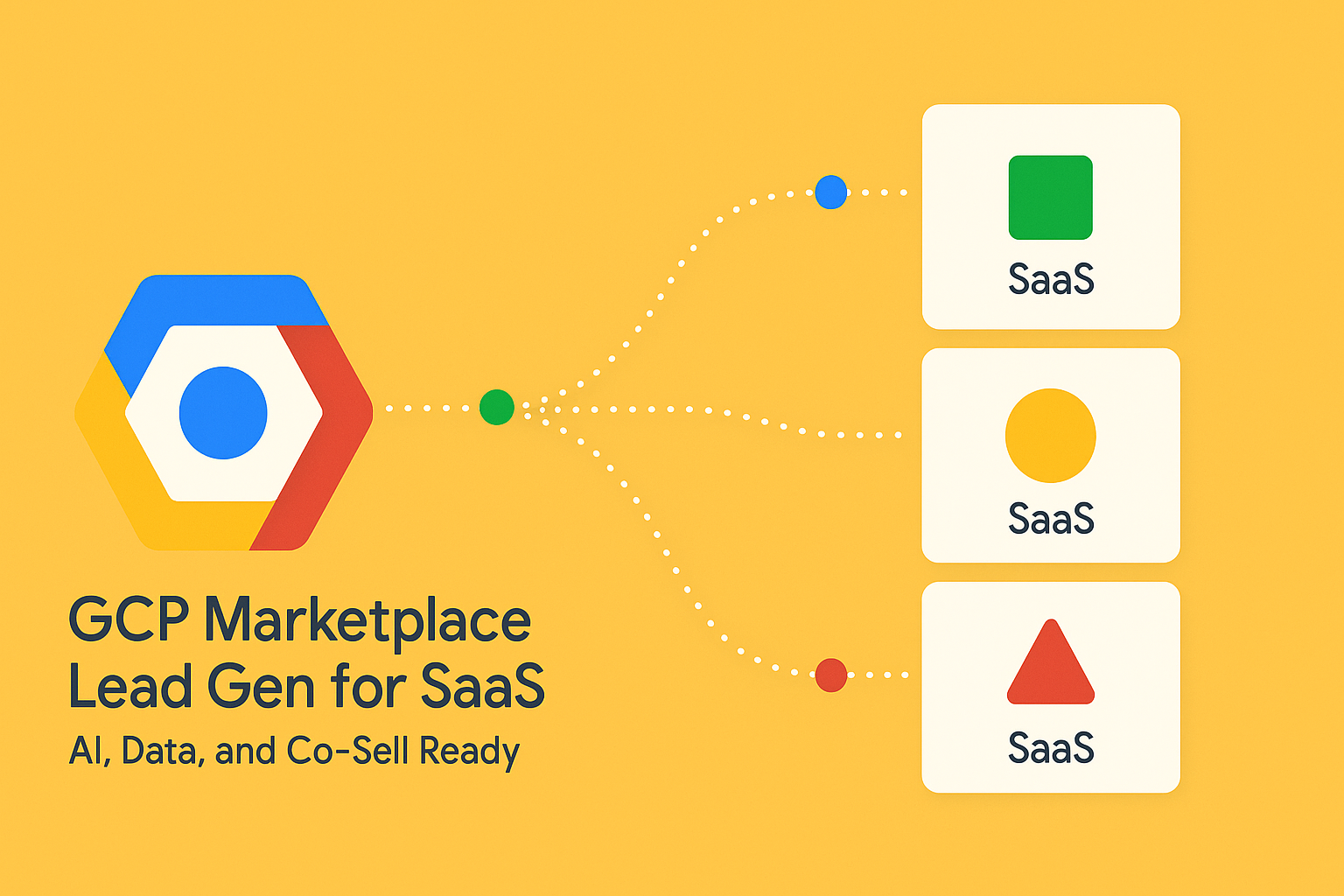

- Enterprise-focused SaaS and AI platforms

- Products with security, compliance, or procurement friction

- Companies targeting regulated industries (finance, healthcare, public sector)

What You Need:

- FTR-approved listing (Foundational Technical Review)

- Co-Sell-ready case studies (named customers, AWS services listed, measurable results)

- Solution overview & project charter tailored for AWS sellers

- Briefing decks that AWS Account Managers can use with clients

- Private offers / CPPO to simplify enterprise procurement

Why It Works:

- AWS sellers bring warm introductions

- Helps you land large, multi-year enterprise contracts

- Positions you as a trusted AWS-aligned partner

Think of it as an enterprise GTM play, powered by AWS’s credibility.

Co-Sell vs Self-Serve: Key Trade-Offs

| Factor | Self-Serve | Co-Sell |

|---|---|---|

| Speed | Fast to launch, quick inbound | Slower, requires validation & enablement |

| Deal Size | Smaller, volume-driven | Larger, enterprise-focused |

| Content Needs | Marketplace listing + docs | FTR pack, case studies, seller enablement |

| Team Involvement | Product-led growth | Sales + Partner Managers |

| Fit For | Developer adoption, SMB SaaS | Enterprise SaaS, AI, Security, Data |

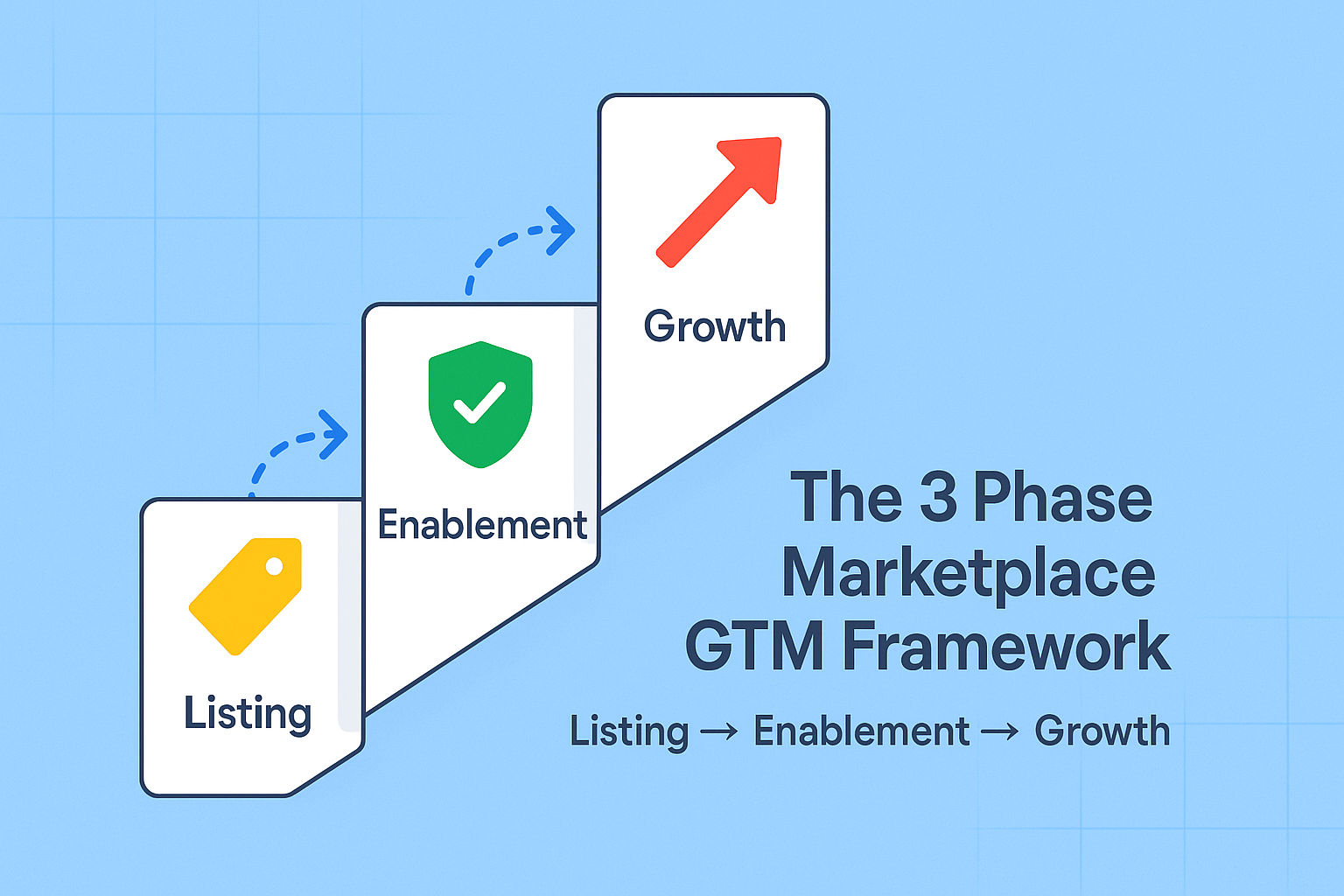

Which Strategy Should You Choose?

- If your product is SMB/developer-focused: Start with self-serve, optimize your listing, and capture inbound traction.

- If your product is enterprise-focused: Invest early in Co-Sell content, it will unlock AWS field sellers, private offers, and bigger deals.

- Hybrid Approach: Many successful AWS ISVs do both:

- Self-serve for developer adoption

- Co-Sell for enterprise expansion

Conclusion

There’s no single “right” AWS Marketplace strategy.

The best path depends on your ICP (ideal customer profile), your product’s complexity, and your sales motion maturity.

- Self-serve is fast, scalable, and great for PLG-driven SaaS.

- Co-Sell is slower, but delivers enterprise credibility and larger revenue impact.

The smartest AWS Partners align both, building a listing that can convert on its own, while also enabling AWS sellers to co-sell it into enterprise accounts.